Generative AI fever sweeps the technology industry in 2023. But behind the market excitement is an underground wave surrounding AI chips, especially GPUs. In AI training, GPU graphics chips dominate CPUs thanks to their ability to conduct a series of calculations in parallel. From the US-China technology war to the mystery behind the unexpected firing of OpenAI CEO Sam Altman, there is the shadow of AI chips.

Thirst for AI chips

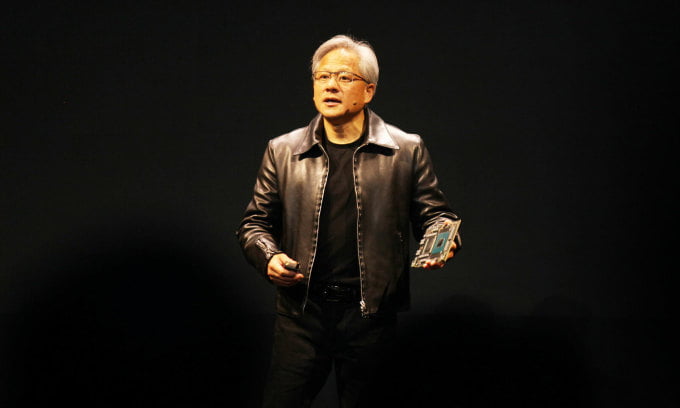

The explosion of generative AI makes Nvidia the brightest star in hardware. The company’s H100 is currently the most powerful GPU graphics chip on the market, used to operate super AI machines. Nvidia CEO Jensen Huang describes this as “the world’s first system designed for super AI”. During the fever, on the black market, each chip costs up to 46,000 USD (more than one billion VND).

According to research company Omdia, in just one quarter, Nvidia sold half a million H100 chips . The thirst for chips has also made Nvidia the world’s largest chip designer . The company’s capitalization value reached 1,000 billion USD, higher than Netflix, Nike and Novo Nordisk combined.

Nvidia CEO Jensen Huang introduced the H100 chip at Computex 2023 Taiwan on May 30. Photo: Khuong Nha

The thirst for chips also makes semiconductor manufacturers unable to sit still. Despite facing a US ban, Huawei is said to have successfully produced basic AI chip models to fill the gap left by Nvidia. According to Reuters , at the end of October, Huawei delivered more than 60% of the order of 1,600 Ascend 910B chips to replace Nvidia A100 on 200 servers for Baidu. Experts assess that 1,600 chips is not a large order but is a signal that the US no longer holds a monopoly and Huawei is being given the opportunity to conquer the 7 billion USD market in its home country.

America’s actions and China’s response

After passing the Chip Act in August 2022, since the beginning of this year, the US has continuously reinforced the ban to prevent China from benefiting from the $53 billion support package. AI chips are items of special note. Nvidia, the company that dominates the GPU market share, is banned from selling advanced chips A100 and H100 to Chinese businesses. After that, lower-end chips like the H800 and A800 were also tightened. The US move is considered a blow to China’s AI ambitions, where a series of technology giants such as Tencent, ByteDance, Baidu, and Alibaba are accelerating the development of large language models (LLM). and AI similar to ChatGPT.

Employees work at the semiconductor chip production line of Jiangsu Azure (China). Photo: Reuters

Immediately after the ban, Chinese companies aggressively hunted and sought to hoard AI chips. According to analysts, the US blocking Nvidia from selling chips could cause China to go backwards in the AI race. In early August, SCMP cited the supply chain that a series of large Chinese technology companies quickly ordered about 100,000 A800 sets worth more than a billion USD from Nvidia, for delivery this year. In addition, other orders with a total price of four billion USD will be delivered in 2024.

On the contrary, Chinese chip manufacturers are optimistic about the ban and see this as a motivation to help them easily access the $41 billion fund . According to Reuters , the Big Fund is being quietly prepared by the Chinese government to become self-sufficient in chip sources, creating a balance with the US $53 billion fund.

Europe also did not sit still when it approved a$47 billion semiconductor support package in April, with the goal of doubling the continent’s chip manufacturing market share to 20% by 2030. SCMP quoted Thierry Breton, Market Commissioner. domestically under the European Commission, that this is the EU’s latest effort to catch up with the US and Asia in semiconductor manufacturing capabilities.

New race

Chips are not only the focus in the technology war between great powers or between semiconductor manufacturers, they are also related to many unrevealed secrets of the technology village.

On November 17, Sam Altman, CEO of OpenAI, was suddenly fired, but was reinstated after 5 days. In documents accessed by Wired , OpenAI in 2019 signed a $51 million agreement to buy chips from Rain AI. The company is based in San Francisco, less than a mile from OpenAI, and works on a chip that simulates the human brain (NPU). Rain AI plans to launch its first product in October next year. A special point is that Altman, in his personal name, also invested one million USD in this company.

For years, Altman has often complained about the high cost of AI chips and predicted that artificial intelligence could create a “devastating crisis” in chips, while asserting that the speed of AI development will depend on new chip designs and supply chains.

The year 2023 ends with a series of “going to war” statements from the world’s leading semiconductor manufacturers. AMD said that the MI300X processor, part of the Instinct MI300 series specializing in generative AI models, has parameters equivalent to the most powerful H100 from Nvidia. Last month, Microsoft introduced the Azure Maia 100 chip to compete with Nvidia. On December 14, Intel announced a dedicated Gaudi3 chip for generative AI. Meanwhile, on November 13, Nvidia also announced the H200 model, expected to hit the market in the second quarter of 2024, and is expected to “create a leap in performance, especially the inference ability of models”. Big Data AI”.

Experts predict AI chips will remain one of the tech industry’s focal points in the coming year as generative AI continues to explode, while artificial general intelligence AGI may soon become a reality as dedicated GPUs be upgraded.

Khuong Nha

Leave a Reply

You must be logged in to post a comment.